Israel has a highly competitive, technologically advanced, and diversified economy with a thriving industrial and service platform. Its GDP per capita in terms of purchasing parity power exceeded $ 45,750 in 2019.

The country’s main agricultural products are fruits and vegetables, cereals, wine, and livestock. Israel is self-sufficient in food, with the exception of cereals. It is a leading country in agricultural technology, "making the desert bloom" to grow a good part of the exported food.

Israel is also one of the world's centers for diamond cutting and polishing, producing nearly a quarter of its exports. Its industrial strength is also significant in the production of chemicals (including medicines), plastics, and high-tech products in aeronautics, electronics, telecommunications, software, and biotechnology, among others.

Its solid educational infrastructure and state-of-the-art business incubation system have allowed the country to create one of the centers with the highest concentration of high-tech companies in the world, backed by privileged access to venture capital in international financial centers.

Israel imports oil, raw materials including rough diamonds, wheat, production inputs, and motor vehicles, among other products.

For more information: https://www.imf.org/en/Countries/ISR

Israel is Mexico´s first commercial partner in the Middle East and our country is the second Latin American commercial partner of Israel. In 2021, bilateral trade between Mexico and Israel summed up to 1,051 million dollars. In the period January-June 2022, total trade totaled 558 million dollars.

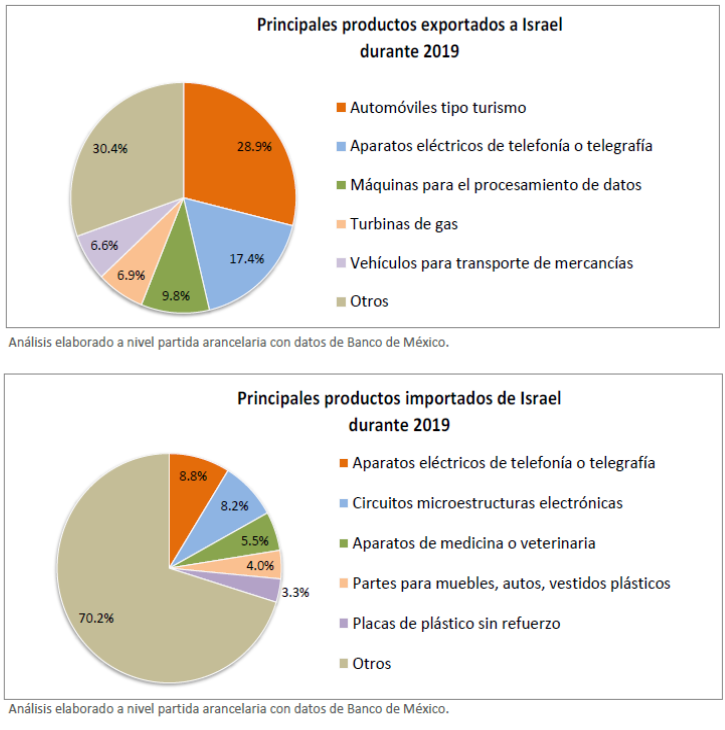

The main Mexican export products to Israel are passenger cars; telephones, including cell phones; vehicles for the transport of goods; memory units; and process units. The main imported products are medicines, medical equipment, processors and controllers; modular circuits; control units or adapters; and plastic plates, sheets, and strips.

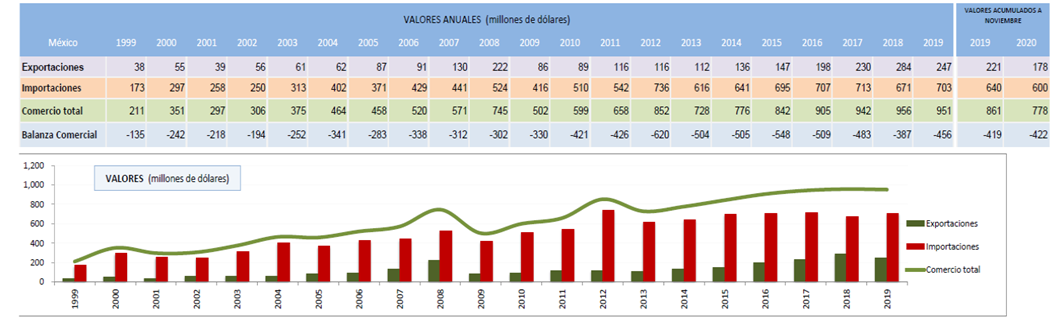

The bilateral trade relationship is part of the Free Trade Agreement (FTA) in force since 2000, whose Modifying Protocol was approved in 2008. The FTA between Mexico and Israel boosted bilateral trade: between 1999 (the year prior to the entry into force of said instrument) and 2021 trade grew 499.05%, going from $ 210.6M to $ 1051.0M.

Source: Ministry of Economy with data from Banco de México

On July 1, 2000, the Free Trade Agreement (FTA) between Mexico and Israel entered into force. In March 2010 it was updated for the first time. The agreement will be renegotiated again in 2021.

The FTA aims to establish a Free Trade Zone to intensify trade and improve both economies through the liberalization of taxes and restrictions on imports originating in both countries. The specific objectives of the treaty include:

- Eliminate obstacles to trade and facilitate the cross-border movement of goods and services.

- Promote conditions of fair competition in the Free Trade Zone.

- Substantially increase investment opportunities.

- Create effective procedures for the application and compliance of the treaty, for its joint administration, and dispute resolution.

- Establish guidelines for subsequent bilateral and multilateral cooperation aimed at expanding and improving the benefits of the treaty.

As can be seen in the data on bilateral trade between Mexico and Israel, the FTA had an extraordinary impact on the economic relations between the two countries. Between the entry into force of the FTA in 2000 and 2018, foreign trade grew exponentially: exports rose by 420.3% (from 54.6 B to 284.1B) while imports increased by 126.5% (from 296.5B to 671.5B). The numbers are even more striking if foreign trade is taken into account before the treaty is signed. In the last 20 years, exports grew by 1,487.1% (from $ 17.9B in 1998 to $ 284.1B in 2018) and imports increased by 388.7% (from $ 137.4B in 1998 to $ 671.5B in 2018).

Fuente: Secretaría de Economía con datos de Banco de México

Free Trade Agreement between Mexico and Israel (Spanish)- http://www.sice.oas.org/Trade/meis_s/text_s.asp

Free Trade Agreement between Mexico and Israel (English) - https://www.gov.il/BlobFolder/policy/free-trade-area-agreement-israel-mexico/he/sahar-hutz_agreements_Mexico-Israel-fta-en.pdf

Free Trade Agreement between Mexico and Israel (Hebrew) - https://www.gov.il/BlobFolder/policy/free-trade-area-agreement-israel-mexico/he/sahar-hutz_agreements_Mexico-Israel-fta-he.pdf

Due to the complementarity between the economies, there are numerous possibilities for cooperation and business opportunities between both countries.

On the one hand, there is interest on the Israeli side to promote the importation of consumer goods, especially agri-food, to lower the high cost of living, which represents opportunities for the diversification of agri-food exports, manufactures, and services.

On the other hand, Mexican companies could benefit from Israeli technological advances in different sectors such as smart mobility, food technologies, cybersecurity, agrotechnology, and water management. Mexican companies, among which Cemex, Bimbo, Mexichem, and Rassini stand out, are expanding their presence in Israel, through R&D centers, subsidiaries, or innovation offices, in order to benefit from the Israeli innovation ecosystem to increase its competitiveness in international markets.

In addition, Mexico offers Israeli technology opportunities for growth in scale, considering the productive capacity and network of free trade agreements make our country a privileged platform for those small and medium-tech startups that seek to grow and compete in new markets.

Israel in Mexico

According to information from the Ministry of Economy, Israel is the 19th investor in Mexico worldwide and the 1st among the Middle East countries, with an accumulated investment of 2,223 million dollars as of September 2020. Israeli investment in Mexico is it was mainly located in manufacturing industries (94.5% of the total); in temporary accommodation and food and beverage preparation services (2.4%); and in commerce (2.3%); located primarily in Mexico City, Jalisco, Nuevo León and the State of Mexico. In Mexico, there are 410 companies with capital from Israel.

Mexico in Israel

Due to the development of the Israeli ecosystem in strategic sectors, multiple Mexican companies have consolidated their presence in recent years to identify talents, new technologies, and cooperation agreements with local startups, to benefit from the Israeli innovation ecosystem. Among the Mexican firms established in Israel stand out Orbia and CEMEX, which acquired leading Israeli companies as well as Bimbo and Rassini, who have established innovation offices. On the other hand, Mexican businessmen have expressed interest in investing in Israeli technologies and companies with a presence in Mexico and Latin America.

In response to geographic and climatic challenges, Israel has become a world leader in water resource management. To optimize the use of hydraulic resources in agriculture, precision risk systems have been developed, including drip irrigation. Of note is the acquisition of the leading Israeli company in the field, Netafim, by Mexichem (currently Grupo Orbia), in 2018. As part of the agreement, the Mexican industrial conglomerate established an innovation center in Israel, from which it seeks technologies and startups that adapt to the groups' needs, including the areas of construction and infrastructure, agriculture and data communications, and basic materials.

Over the past few years, Israel has become a leading research and development center for the automotive sector, noted for advancements in the areas of autonomous driving and connected vehicles. The possibilities of cooperation between the Mexican automotive industry and the Israeli technology scene could increase the added value in the local manufacturing growth of the Mexican economy. Rassini, a leader in the manufacture of brakes and springs for most of the world's largest automotive companies with headquarters in Mexico, saw the opportunity and opened a research and development center at the end of 2019. The project is carried out in cooperation with the Jerusalem College of Technology and AKA Advanced Technologies LTD. It is the first Mexican R&D center in Israel.

The food technology sector (“food-tech”) has been growing around the world and especially in Israel. This trend represents a second wave of agri-food technology innovation-driven both by growing global demand for efficient and sustainable food production technologies and Israel's comparative advantage in artificial intelligence, robotics, Big Data, and computing. The Mexican multinational Bimbo recognized the value of Israeli innovation in the industry and, like other large food production companies, in 2019 opened an innovation and talent search office in Tel Aviv, intending to establish an R&D center soon.

On the other hand, in 2018, Mexican investors created Cantera Capital, an initial venture capital fund with a presence in Mexico City and Tel Aviv that invests in innovation applied to high-impact sectors such as health, education, and agribusiness in Israel and Latin America. During the last conference of the venture capital company OurCrowd, a delegation of 60 Mexican investors participated, interested both in the opportunity to invest in Israeli startups, as well as in the opportunity to bring new technologies to Mexico.