Information about Israel

Form of government: Parliamentary Democracy.

The President is the Head of State. He or she is elected by members of Parliament for a 7-year period, without the possibility of re-election. Among other responsibility, the President bestows the mandate to form a government to a member of Parliament (Knesset), who in their opinion has the best chance of forming a coalition government, and subsequently become Prime Minister (Head of Government).

The Knesset is a unicameral legislature composed of 120 members. In parliamentary elections, Israeli citizens cast their votes for their preferred parties, who draw up their lists of candidates and, according to the results, the seats are distributed proportionally. 61 seats are needed in order to form a government, either by a single party with majority representation or by joining a coalition. Members serve for a four-year term, unless early elections are called.

The Judicial Power is headed by the Supreme Court, made up of 15 judges, and is the highest court in Israel, with ultimate appellate jurisdiction over all other courts.

President: Isaac Herzog, since July 9, 2021.

Prime Minister: Benjamin Netanyahu (Likud) since December 29, 2022.

For more information, please visit the following website: https://mfa.gov.il/mfa/aboutisrael/state/government/pages/default.aspx

The State of Israel is located in the Middle East. It limits to the north with Lebanon and Syria; to the east with Syria, Jordan, and the West Bank; to the south with Egypt, Jordan, and the Gaza Strip, and to the west with the Mediterranean Sea.

Its population is estimated at 9.3 million inhabitants (2021). 50,262% of its population are women and 49,738% are men (2019). About 93% of its population resides in urban areas. The population density is around 410 inhabitants / km2

The official language is Hebrew, and Arabic is an officially recognized language, with special status.

For more information, please visit the following website: https://www.cbs.gov.il/en/subjects/Pages/Population.aspx

Economic relations with Israel

Growth stopped with the COVID-19 pandemic, registering a negative rate of -4% in 2020. The IMF estimates that GDP growth will rebound by 4.9% in 2021 and 5% in 2022, depending on the evolution of the pandemic and global economic recovery. The magnitude of the monetary and fiscal support, as well as the speed of its vaccination campaign, will contribute to this.

Israel has a highly competitive, technologically advanced, and diversified economy with a thriving industrial and service platform. Its GDP per capita in terms of purchasing parity power exceeded $ 42,000 in 2019.

The country´s main agricultural products are fruits and vegetables, cereals, wine, and livestock. Israel is self-sufficient in food, with the exception of cereals. It is a leading country in agricultural technology, "making the desert bloom" to grow a good part of the exported food.

Israel is also one of the world's centers for diamond cutting and polishing, producing nearly a quarter of its exports. Its industrial strength is also significant in the production of chemicals (including medicines), plastics, and high-tech products in aeronautics, electronics, telecommunications, software, and biotechnology, among others.

Its solid educational infrastructure and state-of-the-art business incubation system have allowed the country to create one of the centers with the highest concentration of high-tech companies in the world, backed by privileged access to venture capital in international financial centers.

Israel imports oil, raw materials including rough diamonds, wheat, production inputs, and motor vehicles, among other products.

For more information: https://www.imf.org/en/Countries/ISR

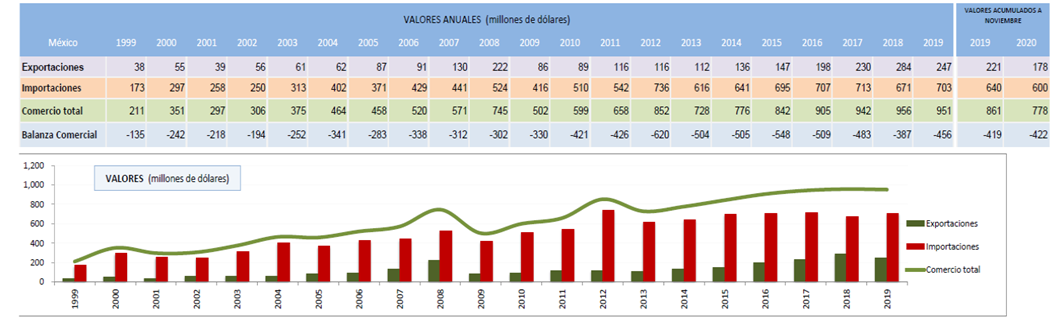

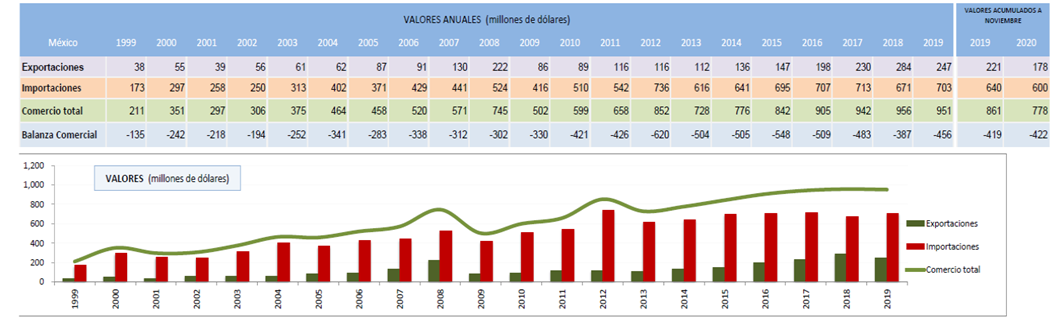

Israel is Mexico´s first commercial partner in the Middle East and our country is the second Latin American commercial partner of Israel. In 2019, bilateral trade

between Mexico and Israel summed up to 951 million dollars. In the period January-November 2020, total trade totaled 778 million dollars, with a deficit balance for Mexico of 422 million dollars.

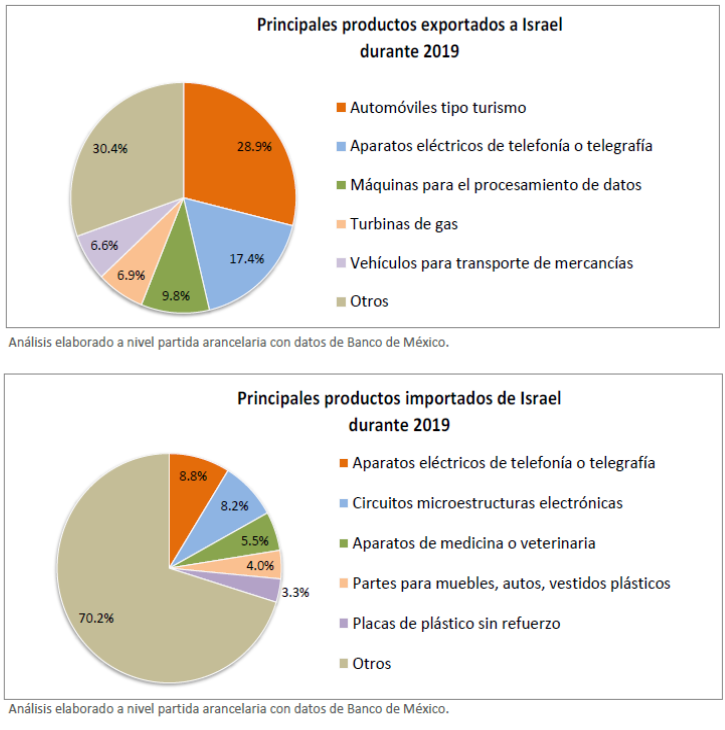

The main Mexican export products to Israel are passenger cars; telephones, including cell phones; vehicles for the transport of goods; memory units; and process units. On the other hand, the main imported products are merchandise for the Sectorial Promotion Program of the Pharmachemical Products, Medicines, and Medical Equipment Industry; processors and controllers; modular circuits; control units or adapters; and plastic plates, sheets, and strips.

The bilateral trade relationship is part of the Free Trade Agreement (FTA) in force since 2000, whose Modifying Protocol was approved in 2008. The FTA between Mexico and Israel boosted bilateral trade: between 1999 (the year prior to the entry into force of said instrument) and 2020 trade grew 304.2%, going from $ 210.6M to $ 851.0M. Exports rose 403.5% in that period, going from $ 37.9M to $ 190.6M, while imports rose by 282.4%, going from $ 172.7 million dollars to $ 660.4 million dollars.

Source: Ministry of Economy with data from Banco de México

On July 1, 2000, the Free Trade Agreement (FTA) between Mexico and Israel entered into force. In March 2010 it was updated for the first time. The agreement will be renegotiated again in 2021.

The FTA aims to establish a Free Trade Zone to intensify trade and improve both economies through the liberalization of taxes and restrictions on imports originating in both countries. The specific objectives of the treaty include:

- Eliminate obstacles to trade and facilitate the cross-border movement of goods and services.

- Promote conditions of fair competition in the Free Trade Zone.

- Substantially increase investment opportunities.

- Create effective procedures for the application and compliance of the treaty, for its joint administration, and dispute resolution.

- Establish guidelines for subsequent bilateral and multilateral cooperation aimed at expanding and improving the benefits of the treaty.

As can be seen in the data on bilateral trade between Mexico and Israel, the FTA had an extraordinary impact on the economic relations between the two countries. Between the entry into force of the FTA in 2000 and 2018, foreign trade grew exponentially: exports rose by 420.3% (from 54.6 B to 284.1B) while imports increased by 126.5% (from 296.5B to 671.5B). The numbers are even more striking if foreign trade is taken into account before the treaty is signed. In the last 20 years, exports grew by 1,487.1% (from $ 17.9B in 1998 to $ 284.1B in 2018) and imports increased by 388.7% (from $ 137.4B in 1998 to $ 671.5B in 2018).

Fuente: Secretaría de Economía con datos de Banco de México

Free Trade Agreement between Mexico and Israel (Spanish)- http://www.sice.oas.org/Trade/meis_s/text_s.asp

Free Trade Agreement between Mexico and Israel (English) - https://www.gov.il/BlobFolder/policy/free-trade-area-agreement-israel-mexico/he/sahar-hutz_agreements_Mexico-Israel-fta-en.pdf

Free Trade Agreement between Mexico and Israel (Hebrew) - https://www.gov.il/BlobFolder/policy/free-trade-area-agreement-israel-mexico/he/sahar-hutz_agreements_Mexico-Israel-fta-he.pdf

Due to the complementarity between the economies, there are numerous possibilities for cooperation and business opportunities between both countries.

On the one hand, there is interest on the Israeli side to promote the importation of consumer goods, especially agri-food, to lower the high cost of living, which represents opportunities for the diversification of agri-food exports, manufactures, and services.

On the other hand, Mexican companies could benefit from Israeli technological advances in different sectors such as smart mobility, food technologies, cybersecurity, agrotechnology, and water management. Mexican companies, among which Cemex, Bimbo, Mexichem, and Rassini stand out, are expanding their presence in Israel, through R&D centers, subsidiaries, or innovation offices, in order to benefit from the Israeli innovation ecosystem to increase its competitiveness in international markets.

In addition, Mexico offers Israeli technology opportunities for growth in scale, considering the productive capacity and network of free trade agreements make our country a privileged platform for those small and medium-tech startups that seek to grow and compete in new markets.

Israel in Mexico

According to information from the Ministry of Economy, Israel is the 19th investor in Mexico worldwide and the 1st among the Middle East countries, with an accumulated investment of 2,223 million dollars as of September 2020. Israeli investment in Mexico is it was mainly located in manufacturing industries (94.5% of the total); in temporary accommodation and food and beverage preparation services (2.4%); and in commerce (2.3%); located primarily in Mexico City, Jalisco, Nuevo León and the State of Mexico. In Mexico, there are 410 companies with capital from Israel.

Mexico in Israel

Due to the development of the Israeli ecosystem in strategic sectors, multiple Mexican companies have consolidated their presence in recent years to identify talents, new technologies, and cooperation agreements with local startups, to benefit from the Israeli innovation ecosystem. Among the Mexican firms established in Israel stand out Orbia and CEMEX, which acquired leading Israeli companies as well as Bimbo and Rassini, who have established innovation offices. On the other hand, Mexican businessmen have expressed interest in investing in Israeli technologies and companies with a presence in Mexico and Latin America.

In response to geographic and climatic challenges, Israel has become a world leader in water resource management. To optimize the use of hydraulic resources in agriculture, precision risk systems have been developed, including drip irrigation. Of note is the acquisition of the leading Israeli company in the field, Netafim, by Mexichem (currently Grupo Orbia), in 2018. As part of the agreement, the Mexican industrial conglomerate established an innovation center in Israel, from which it seeks technologies and startups that adapt to the groups' needs, including the areas of construction and infrastructure, agriculture and data communications, and basic materials.

Over the past few years, Israel has become a leading research and development center for the automotive sector, noted for advancements in the areas of autonomous driving and connected vehicles. The possibilities of cooperation between the Mexican automotive industry and the Israeli technology scene could increase the added value in the local manufacturing growth of the Mexican economy. Rassini, a leader in the manufacture of brakes and springs for most of the world's largest automotive companies with headquarters in Mexico, saw the opportunity and opened a research and development center at the end of 2019. The project is carried out in cooperation with the Jerusalem College of Technology and AKA Advanced Technologies LTD. It is the first Mexican R&D center in Israel.

The food technology sector (“food-tech”) has been growing around the world and especially in Israel. This trend represents a second wave of agri-food technology innovation-driven both by growing global demand for efficient and sustainable food production technologies and Israel's comparative advantage in artificial intelligence, robotics, Big Data, and computing. The Mexican multinational Bimbo recognized the value of Israeli innovation in the industry and, like other large food production companies, in 2019 opened an innovation and talent search office in Tel Aviv, intending to establish an R&D center soon.

On the other hand, in 2018, Mexican investors created Cantera Capital, an initial venture capital fund with a presence in Mexico City and Tel Aviv that invests in innovation applied to high-impact sectors such as health, education, and agribusiness in Israel and Latin America. During the last conference of the venture capital company OurCrowd, a delegation of 60 Mexican investors participated, interested both in the opportunity to invest in Israeli startups, as well as in the opportunity to bring new technologies to Mexico.

Innovation Ecosystem

Israel benefits from an “innovation ecosystem” that has turned entrepreneurship and technology into engines of economic growth, and in which the government, private sector, and academia actively participate. Taking advantage of government incentives and the availability of venture capital, this environment promotes the creation of new companies (“start-ups”) capable of transforming the latest scientific advances into practical solutions with added value.

The performance of the Israeli ecosystem has been recognized by large multinational companies (Intel, General Motors, Microsoft, Cisco, among others) through acquisitions (“exits”) and the establishment of research and development (R&D) centers, a trend that has consolidated Israeli leadership in multiple sectors. According to PwC Israel's report on tech company acquisitions, in 2020 while there were fewer bids - only 60 compared to 80 in 2019 - their cumulative value increased 55% to $ 15.4 billion, from $ 9.9 billion last year. The average transaction size increased 207% to $ 257 million. Furthermore, 2020 was a record year for initial public offerings, with 19 Israeli companies going public, up from 13 in 2019. Additionally, IPO's share of the total value of transactions rose to $ 9.3 billion (or 60 % of the total value of the transaction), compared to $ 2.2 billion in 2019 (or 22% of the total value of the transaction). The average value per IPO also rose sharply from $ 169 million in 2019 to $ 489 million in 2020, primarily led by

Lemonade, JFrog, and Nanox in the US, and Ecoppia and Aquarius Engines in Israel. In addition, of the more than 60 companies founded by Israeli entrepreneurs that have achieved “unicorn” status (private companies valued at more than $ 1 billion), 16 have joined the list in 2020 and another 10 in the first four months. of 2021.

2020 was characterized by the development of the sector of digital medicine, financial technology (“fintech”), cryptocurrencies, and digital commerce. The cybersecurity, autonomous driving, and food technology sectors continued to rise this year, hand in hand with the inauguration of incubators and research and development (“R&D”) centers, and large investments by foreign multinationals.

Israel's achievements in the areas of science, technology, and innovation are recognized globally, including the highest gross spending on innovation and development (R&D), the highest number of NASDAQ-listed companies outside the United States, and the higher level of venture capital as a percentage of GDP. Although multiple elements are necessary to create a successful business technology sector, including knowledge, human, social, entrepreneurial, and financial capital, the set of public policies that have played a key role in promoting technological innovation in research and development stands out. industrial development.

Numerous diagnoses, including Laws encouraging technological innovation in Israel, have identified among the main factors of success in the Israeli innovation ecosystem: the number of highly trained engineers and scientists; the existence of academic institutions of international level; compulsory military service and risk-taking culture; which have a direct impact on the formation of human, social and entrepreneurial capital. On the other hand, the Israeli government has encouraged and improved free market participation in the availability of financial capital through legislation. From the 1980s to the present day, the Israeli government has made strategic decisions intending to make capital available to entrepreneurs and make the economic return on investment more attractive, thus compensating for market failures. and market risks, promoting the accelerated development of science and technology-related industries in the country.

The Israeli legal framework is made up of three main instruments: (1) the Law for the Promotion of Industrial Research, Development and Technological Innovation(1984); (2) the Office of the Chief Scientist of the Ministry of Industry, Trade, and Labor (OCJ) established in 1969; and (3) the law reform that established the Israel Innovation Authority (AII) in 2016. Other relevant instruments include the 2005 reforms to the Tel Aviv Stock Exchange (TASE) rules that facilitate small and medium-sized companies such as R&D companies access to capital through initial public offerings.

Numerous analyzes explain the success of the Israeli “innovation ecosystem” based on the significant presence of highly trained human capital; the existence of academic institutions of the international level; and the discipline, technology, and culture of risk management fostered by the IDF´s conscription. However, it is necessary to underline that, through the current regulatory framework, the Israeli government has managed to identify and resolve obstacles and market failures through legislation and state intervention to promote innovation and technological development.

Working together with academia and the private sector (both local and international), Israel has developed several institutions and incentives that promote a collaborative environment, facilitate a better distribution of risks and the reduction of coordination barriers, to consolidate the potential of investment in R&D. Thanks to these measures, the Israeli innovation ecosystem offers the private sector the confidence necessary to stimulate free market participation in the development of industrial and commercial R&D, as well as investment in goods and services with high added value.

In conclusion, through the establishment of a framework law, the creation of specialized agencies, as well as the implementation of tax and regulatory reforms, Israel has managed to reduce information asymmetries, encourage collaboration and manage the risks inherent in the development of technological solutions for a global market, as well as generating a context in which the availability of financing opportunities and public subsidies has a great impact and a multiplier effect on business activity and economic growth.

Sources:

PwC Israel, Exit Report 2020.

_______. 1984. Encouragement of Industrial, Research and Development Law (Unofficial translation): shorturl.at/hrzCQ.

_______. 2011. “Start-up nation: An innovation story” (2011), OECD Observer: shorturl.at/mvEW5.

_______. 2019. “The State of Innovation Operating model frameworks, findings and resources for multinationals innovating in Israel”, PwC y Startup Nation Central: shorturl.at/kwQSZ.

Baratz, Y. 2019. “The Israel Innovation Authority to facilitate collaboration between industry and research institutions”, Pearl Cohen: shorturl.at/akCS4.

Getz, D. and I. Goldberg. 2016. “Best Practices and Lessons Learned in ICT Sector Innovation: A Case Study of Israel”, The World Development Report 2016, The World Bank: shorturl.at/htBHZ.

Lach, S., S. Parizat and D. Wasserteil. 2008. “The impact of government support to industrial R&D on the Israeli economy”, E.G.P Applied Economics Ltd. Research and Consulting in Economics, Marketing and Social Sciences: shorturl.at/hjot0.

Stone, H. A. 2017. “Laws Encouraging Technological Innovation in Israel”: shorturl.at/pwJVX.

Treatment

In response to geographic and climatic challenges, Israel has become a world leader in water resource management. Currently, Israel recycles approximately 80% of its wastewater for irrigation through a system of 120 treatment plants; among which the facilities in Haifa (37 million cubic meters per year), Jerusalem-Sorek (23 million cubic meters per year), and Dan-Shafdan (120 million cubic meters per year) stand out.

In 2018, the delegation chaired by the governor of Aguascalientes visited the Dan-Shafdan treatment plant. Two Israeli companies in this sector, Aqwise, and ODIS Filtering have representative offices in Mexico.

Desalination

Likewise, Israel has developed desalination plants to make seawater drinkable. There are currently 5 plants of this type, which provide 65% of the drinking water in the country. Among the companies active in this field are Desalitech, which joined Veolia in 2014 to introduce this type of technology to Mexico.

Water management and water use optimization

To optimize the use of hydraulic resources in agriculture, different companies have developed precision risk systems, including drip irrigation. In this context, the recent acquisition of the leading Israeli company in the field, Netafim, by the Mexican conglomerate Orbia stands out. Other companies have developed solutions to reduce losses caused by leaks in distribution systems. The Takadu company, for example, offers a sensor system that detects leaks in municipal pipes, to reduce water waste.

Relevant technology companies in the sector

Water companies catalogue – Israel Export Institute

- https://www.export.gov.il/en/%20water/watercatalogue

- https://www.export.gov.il/en/cleantech/cleantechcatalogue

Buscador de compañías tecnológicas - Startup Nation Central Finder

- https://finder.startupnationcentral.org/tag/water

- https://finder.startupnationcentral.org/tag/cleantech

International exhibitions and conferences in Israel

In response to its geographic and climatic challenges, as well as the relative scarcity of natural resources, Israel has made significant strides in the field of technology for agriculture (agri-tech) and food production (food tech). In addition to optimizing hydraulic resources, in recent years new systems have been developed based on data management and connectivity (Internet of things) to allow producers to optimize basic processes through a wide range of tools including specialized sensors installed in the soil and plants; drones and robots; genetic modification; smart irrigation; and software for the collection and analysis of big data (big data).

The food industry is considered one of the most important industries in the world, with an estimated value of $8.7 billion in 2018. The food technology sector (food tech) has been growing around the world and especially in Israel. This trend represents a second wave of agri-food technology innovation-driven both by growing global demand for efficient and sustainable food production technologies and Israel's comparative advantage in artificial intelligence, robotics, Big Data, and computing. In 2018 alone, agri-food technology companies obtained more than $100 million in capital investments. In 2018, more than 300 startups were registered in food tech, specialized in the areas of cultivated meat, new sources of protein, food personalization, digitization, connectivity, and applications in the field of food, among others. The Israel Innovation Authority supports the development of the sector with R&D projects and the two food tech-oriented incubators, The Kitchen Hub and FreshStart.

Relevant technology companies in the sector

Agritech and foodtech Companies Finder - Startup Nation Central Finder

- https://finder.startupnationcentral.org/tag/agtech

- https://finder.startupnationcentral.org/tag/agriculture

- https://finder.startupnationcentral.org/tag/foodtech

Foodtech companies catalogue – Instituto de Exportación de Israel

Due to its political context, as well as the close collaboration between the public and private sectors, Israel ranks highly globally in the fields of security and cybersecurity; including, in addition to the manufacture of weapons and combat aircraft, satellites, drones, and various surveillance tools.

During the last three decades, the State of Israel has maintained an important leadership in cybersecurity innovation, as well as the ability to develop innovative solutions to the emergence of new cyber threats. This experience is reflected in the constant and accelerating flow of venture capital funds in the Israeli cybersecurity industry, which accounted for 15-20% of global private investments in cybersecurity in 2019 ($114 million).

The government is actively involved in the development of the cybersecurity sector, with active participation from the private sector and academia. In 2019, the cybersecurity ecosystem in Beersheba was inaugurated, to bring together multinationals, startups, venture capital, the academy, and intelligence units of the Israeli army. In addition, the Israeli Innovation Authority offers scholarships to support research and development programs in cyber defense technology, along with the establishment of technology innovation laboratories specifically focused on this sector.

Currently, there are 400 cybersecurity companies registered in Israel, of which 35 generate revenue of more than $10 million per year. Thirty of them already operate in Mexico, mainly providing services to the energy and financial sectors, either through distributors or through branches in our country. Various Israeli cybersecurity companies provide services to governments, including Toka Cyber, InElint, and Cygov. The Elbit and MER companies have Mexican subsidiaries.

Relevant technology companies in the sector

Cybersecurity Companies Finder - Startup Nation Central Finder

- https://finder.startupnationcentral.org/startups/search?list_1_action=and&list_1_tag=cyber-security

- https://finder.startupnationcentral.org/tag/defense

Homeland-Security companies catalogue – Instituto de Exportación de Israel

SIBAT - Directorate of International Defense Cooperation in the Ministry of Defense of Israel

International exhibitions and conferences in Israel

The global automotive industry is undergoing a major transition to high technology and each year vehicles contain more sophisticated elements of information technology and sensors. Over the past few years, Israel has become a leading research and development center for the automotive sector, noted for advances in the areas of autonomous driving and connected vehicles. Volkswagen, General Motors, and Ford, among other large multinationals, have already opened their R&D centers in Israel to identify talents and new technologies and collaborate with local startups.

Although Israel does not manufacture vehicles on a large scale, it has become a global laboratory for autonomous and intelligent transportation. The Israeli automotive industry is made up of veteran companies that specialize in Tier 1, 2, and 3 vehicle assembly and supply, engaged in traditional and advanced manufacturing processes, and companies that specialize in innovation, advanced technologies, and facilitation of manufacturing processes. Israeli automotive companies, originally established to support, among others, the security and aviation industries, have successfully adapted relevant technologies that were used for military and civilian use and became a prominent technology destination for global companies in the field, becoming leaders in the field of autonomous vehicle technologies. Israel's leadership in transportation management systems, computer vision, sound system control, gesture recognition, cybersecurity, location-based services, big data and more, makes the driving experience smarter, faster, safer, and more energy-efficient.

Relevant technology companies in the sector

Autotech Companies Finder - Startup Nation Central Finder

https://finder.startupnationcentral.org/tag/automotive

Automotive technology companies catalogue – Instituto de Exportación de Israel

https://www.export.gov.il/en/auto/automotivecatalogue

International exhibitions and conferences in Israel

The Fintech industry in Israel is one of the most developed markets in the world. Hundreds of local startups are developing new technologies to facilitate payment processes, reduce fraud, manage capital and user savings, promote financial education and planning, and develop virtual currencies. Like other tech sectors in Israel, the country's fintech sector is a by-product of innovations from other fields, primarily cybersecurity.

Due to the advanced development of Israeli innovation in the industry, in recent years, international financial institutions - including Citibank and Barclays - entered Israel to identify and cooperate with fintech startups in the local market. Today Israel has more than 500 companies in the Fintech sector and 14 multinational R&D centers.

Relevant technology companies in the sector

Fintech Companies Finder - Startup Nation Central Finder

https://finder.startupnationcentral.org/tag/fintech

Fintech companies catalogue – Instituto de Exportación de Israel

https://www.export.gov.il/en/%20fintech/fintechcatalogue

International exhibitions and conferences in Israel

The digital health sector is one of the most promising areas in terms of global growth, reaching a market size of more than $ 200 billion globally by 2024. Israel is one of the leading countries in this ecosystem: its share of investment has grown significantly between 2014 and 2019, from 1.5% of global investments in digital health to 4.5%, while the country's population represents approximately 0.1% of the world's population.

The digital health sector is the confluence of healthcare and technology, with a focus on healthcare delivery and consumption. Digital health is primarily concerned with making medicine more personal, continuous, accurate, and data-driven, using smart mobile applications, supported by sensor technologies and advanced wearable devices to empower patients by providing highly effective health management tools. efficient and accessible. With these tools, healthcare professionals, along with patients themselves, can monitor, predict, diagnose, and treat a wide range of health conditions. In the healthcare business space, healthcare analytics platforms, powered by artificial intelligence and machine learning algorithms, are dramatically improving medical decisions and clinical workflow. With a unique skill set of capabilities in information, communication technology, and cybersecurity, Israel has an unmatched advantage in health analytics, complemented by more than 25 years of experience in implementing health IT, electronic medical records, and big data analysis.

With steady growth over the last decade (some 80 new companies are formed each year), Israel has introduced creativity and innovation in the digital health field, and today there are more than 1,500 companies active. The largest sector is medical devices and digital health (more than 70 percent of companies). In the field of medical devices, Israeli scientists and engineers have integrated advanced technologies in electronics, communications, and electro-optics to develop world-class innovations in digital imaging, medical lasers, telemedicine, early diagnosis, smart surgical equipment, and more.

Relevant technology companies in the sector

Digital health Companies Finder - Startup Nation Central Finder

- https://finder.startupnationcentral.org/tag/medical-devices

- https://finder.startupnationcentral.org/tag/digital-healthcare

International exhibitions and conferences in Israel