Economic Relations with Belgium, Luxembourg and the European Union

Economic Relations with Belgium

The Belgian Economy

GDP in 2019 (IMF)

25th economy in the world with a GDP of $ 517.6 billion dollars.

1.4% growth, slightly less than the 1.5% registered in 2018. Economic activity was supported by strong domestic demand. The labor market also improved, with the unemployment rate falling to a record low of 5.4%.

Economy in 2020 in the context of the effects of the COVID-19 Pandemic (ECB, EC, IMF, OECD)

The first cases of COVID-19 were confirmed in early March 2020 and infections spread rapidly thereafter. The number of new confirmed cases peaked in Apr 2020.

On 17mar2020 a temporary government was formed to face the coronavirus emergency. This new administration was given enhanced executive powers for a period of up to 6 months to take exceptional measures by decree to deal with the impact of the coronavirus crisis.

The nationwide lockdown began to be lifted on May 4, 2020. By June, many of the restrictions had been lifted. Most companies resumed operations and international borders were reopened.

Economic Impact

Economic activity declined dramatically during the national shutdown period, estimated to be roughly 25% lower compared to the pre-Covid period.

The drop in sales was especially serious in sectors such as the restaurant and hotel businesses, with drops of over 80%.

¼ of all households suffered a loss of at least 10% of their income since the lockdown.

Business confidence declined notably, mainly in the service sectors, while around 65% of companies postponed their investment plans.

Measures to address the economic effects of the pandemic

A fiscal allocation of between 8,000 to 10,000 million euros (about 2% of GDP) was announced for a series of measures such as improving support for the unemployed and deferring tax payments and social security for companies and entrepreneurs, as well as for new health expenditures to combat the COVID-19 crisis.

Regional governments also announced additional measures, including guarantees and compensation plans for affected companies, and the suspension of utilities payments to the unemployed.

2020 economic forecast

IMF: contraction of 6.9%.

EC: contraction of 8.7%.

Economic activity is expected to begin to recover in 3Q-2020, after signs of acceleration in business volume in June 2020, after the lifting of the most restrictive measures.

Short-term outlook (EC-IMF)

Growth 2021:

IMF: 4.6%, EC: 6.5%

Measures to protect employment, family and corporate income, as well as measures to support the ECB's liquidity, are expected to support domestic demand from mid-2020 and boost economic recovery in 2021.

As a result of lower growth in world trade, the contribution of net exports to real GDP growth is expected to remain negative, as in the previous year.

The biggest risk to these forecasts is that the pandemic will resurface, leaving the already weakened Belgian economy less capable of

Bilateral Trade Mexico-Belgium

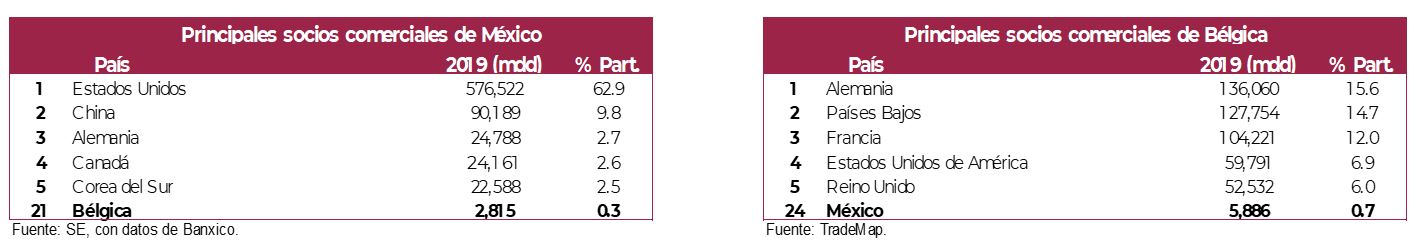

According to data from the Ministry of the Economy (SE), in 2019, Belgium was Mexico's 21st trading partner worldwide and 7th among the Member States of the European Union.

Bilateral trade with Belgium:

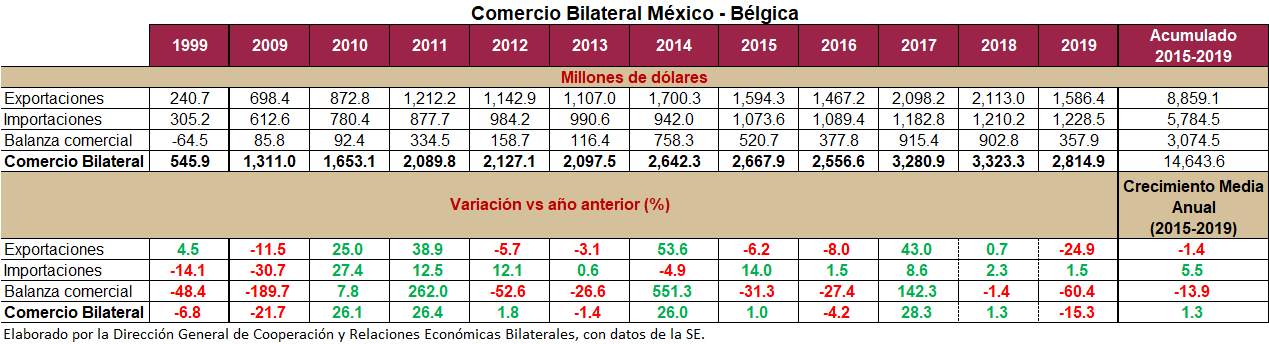

$ 2,814.9 million dollars in 2019, 15.3% lower than in 2018 ($ 3,323.3 million dollars).

Mexican exports: $ 1,586.4 million, 24.9% lower than in 2018 ($ 2,113 million).

Imports of Belgium products: $ 1,228.5 million dollars, 1.5% higher than in 2018 ($ 1,210.2 million dollars).

Mexico had a surplus of $ 357.9 million dollars, lower than the one registered in 2018 ($ 902.8 million dollars).

Mexico-EU Trade Agreement 2000-2019:

With the Free Trade Agreement between Mexico and the European Union, trade between the two countries grew 416%, going from $ 545.9 million in 1999 to $ 2,814.9 million in 2019.

Trade between Mexico and Belgium increased at an Annual Average Growth Rate (AAGR) of 8.5% in the reference period. Mexican exports grew 9.9% AAGR, from $ 240.7 million dollars in 1999 to $ 1,586.4 million dollars in 2019 and imports increased 7.2% AAGR, going from $ 305.2 million dollars in 1999 to $ 1,228.5 million dollars in 2019.

Evolution of bilateral trade

After 2 years of growth, during 2019 there was a significant decrease of 15.3%:

Exports registered an important decrease, in which the drop in sales of zinc minerals and their concentrates stands out; as well as inorganic or mineral coloring materials; passenger cars, acyclic carboxylic acids; and vinyl chloride polymers.

Imports registered a marginal increase, driven mainly by growth in malt; frames, panels, consoles; vegetables; flat products of iron or non-alloy steel; and faucet items.

In the last 5 years (2015-2019), bilateral trade registered an Annual Average Growth Rate (AAGR) of 1.3%, going from $ 2,642.3 million dollars in 2014 to $ 2,814.9 million dollars in 2019.

In this same period, Mexican exports fell 1.4% AAGR, going from $ 1,700.3 million dollars to $ 1,586.4 million dollars.

While imports of products from Belgium increased by 5.5% of AAGR, going from $ 942 million dollars in 2014 to $ 1,228.5 million dollars in 2019.

Mexico

Main export categories: passenger cars; microphones and their stands; centrifugal dryers; copper waste and scrap; and medical instruments and apparatus.

Main import categories: malt; medicines; air or vacuum pumps; propylene polymers; and mineral or chemical nitrogen fertilizers.

Business opportunities

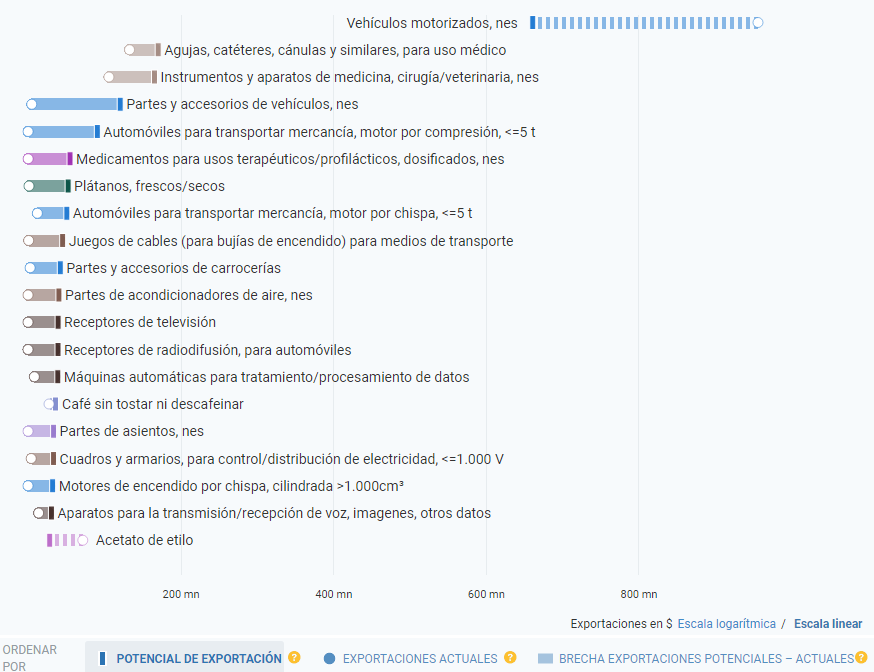

According to data from the International Trade Center (ITC), the products with the greatest export potential from Mexico to Belgium are vehicles and their parts (motorized vehicles; vehicle parts and accessories; automobiles for the transport of goods; bodywork parts and accessories; spark ignition engines); medical devices (needles, catheters, cannulas and the like for medical use; medical, surgical / veterinary instruments and apparatus); medications (for therapeutic / prophylactic uses); agro-food (banana, coffee); machinery (sets of cables (for spark plugs) for means of transport; parts of air conditioners; panels and cabinets, for control / distribution of electricity); electronic equipment (televisions; car stereos; automatic machines for data processing / processing; apparatus for the transmission / reception of voice, images, other data); various manufactures (parts of seats) and chemical inputs (ethyl acetate).

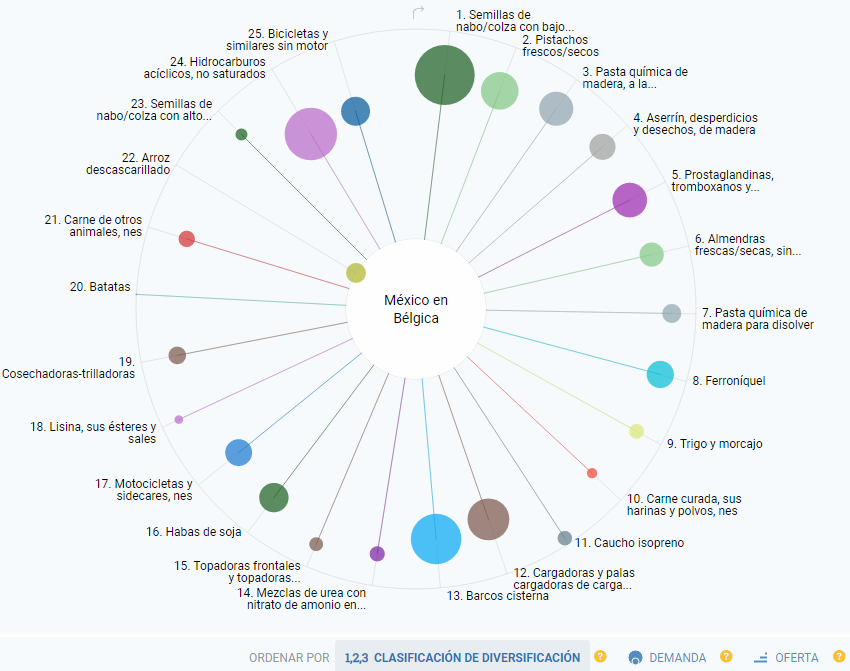

The best diversification options for Mexico in the Belgian market are turnip / rapeseed, fresh / dried pistachios and input from the paper industry (chemical wood pulp).

For Mexico it is easier to sell sweet potatoes than potatoes.

Turnip / rapeseed is facing the greatest potential demand in Belgium.

Investment between Belgium and Mexico

Belgium in Mexico

According to information from the SE, Belgium is the world´s 7th largest investor in Mexico and the 4th among the Member States of the European Union.

Belgium's accumulated FDI in Mexico, between January 1999 and June 2020, amounted to $ 20,891.6 million dollars.

* / With information as of June 30, 2020. Millions of dollars (mdd). Prepared by the Mexican Ministry of foreign Affairs, with data from the Mexican Ministry of Economy.

There are 419 companies in Mexico with capital from Belgium.

In the five-year period 2015-2019, FDI flows totaled 4,415.4 million dollars, the figure is lower than that corresponding to the previous five-year period 2010-2014 when it reached a total of 14,986.8 million dollars due to high investment in the beverage sector (13,285 million dollars). This operation was the purchase of Grupo Modelo by the Belgian company Anheuser-Busch InBev.

Sectors

Belgium's FDI went mainly to the manufacturing sector (96.1%), mining (1.3%), and construction (0.7%).

Belgian FDI in the manufacturing sector, which totaled 20,078.1 million dollars in the period Jan1999-Jun2020, was located almost entirely (97.5%) in the beverage and tobacco industry.

Regarding Belgium's FDI in the mining sector, which totaled 265.2 million dollars, it was located entirely in mining of metallic and non-metallic minerals, except oil and gas.

The construction sector attracted a FDI from Belgium for 141.1 million dollars, which was located in the construction of engineering works (50.4%) and in buildings (49.6%).

States

Just over 50% of Belgium's FDI was distributed in the State of Mexico (13.9%), Mexico City (12.4%), Zacatecas (9%), Oaxaca (7.9%), and Jalisco (7.5%).

Three entities captured 16.5% of FDI: Guanajuato (7.4%), San Luis Potosí (5.4%) and Guerrero (3.7%).

Belgium FDI January-June 2020

However, in the first half of 2020, Belgium's FDI in Mexico decreased 76.5%, compared to the same period of 2019, going from 734.2 million dollars to 172.6 million dollars.

This result was influenced by a reduction in investment of 78.4% in the manufacturing sector.

Mexico in Belgium

According to information from the International Monetary Fund, the stock1 to 2018 of Mexico's investment in Belgium is reported as confidential.

1) Stocks of FDI, also called stocks or positions of FDI, indicate investment levels at a given time. They represent the value of the shares and other equity and debt instruments held by foreigners at the end of the reference period, usually one year.

Economic relations with Luxembourg

Luxembourg Economy

GDP in 2019 (EC-IMF)

72nd economy in the world with a GDP of $ 69.5 billion dollars.

2.3% growth, less than the 3.1% registered in 2018. The dynamism of private consumption was the main driver of economic activity, however, the contribution of net exports to growth decreased notably amid weaker activity in international financial services, which are the key driver of exports in the services sector of Luxembourg.

Economy 2020 in the context of the effects of the COVID-19 Pandemic (ECB, EC, IMF, LTI, OECD, STATEC)

The first case of COVID-19 in Luxembourg occurred on 29Feb2020. The pandemic spread rapidly in March and reached its peak in early April.

On 16mar2020, the authorities advised against all non-essential travel to other countries.

Stores reopened on May 11, 2020 and restaurants reopened on May 29, 2020, taking the necessary precautions to protect their customers. On May 04, 2020, schools were re-opened, with children splitting school attendance and home schooling, in order to maintain social distancing. The COVID-19 Advanced Health Centers were closed on 08Jun2020 because they were no longer needed.

Economic impact

Economic activity in Luxembourg remained relatively stable during the first two months of the year, but declined sharply since March after the closure measures were implemented. In 1Q-2020, GDP contracted 2.9% compared to 4Q-2019.

Short-term indicators showed a rapid deterioration in the economic situation in 2Q-2020. Unemployment rose sharply in March and April, and the May business survey reported the lowest confidence level since the global financial crisis.

It is estimated that private consumption fell by around 16%. Non-residential and government fixed investment are estimated to have fallen by more than 21% in 2Q-2020.

The hardest hit sectors were those directly affected by a total or partial closure of their activity (construction, hospitality, retail trade) and / or where telework options were limited.

Measures to address the economic effects of the pandemic

On 25Mar2020, the government launched a massive economic stabilization program, which includes around 40 different measures totaling a budget of 8.8 billion euros, or more than 14% of GDP. This program, which has been rated as one of the most generous in the world, focuses on helping companies maintain employment and cash flow and facilitate bank loans. Several initiatives were also launched to support business start-ups.

The Ministry of Economy presented on May 20, 2020, additional support measures aimed at encouraging employment, supporting companies in the most affected sectors and promoting a sustainable economic relaunch.

2020 Economic Forecast

IMF: contraction of 4.9%.

EC: 6.2% shrinkage

Private consumption is estimated to decline notably, due to the pandemic and its associated containment measures and also due to a weaker labor market.

The shutdown is likely to have reduced both cross-border consumption of fuels and tobacco, as well as consumption of the large number of cross-border workers in Luxembourg. However, government measures are expected to mitigate the impact on overall consumption.

Net exports are expected to weigh negatively on growth due to the decline in international trade.

Short-term outlook (EC-IMF)

Growth 2021: EC: 5.5%; IMF: 4.8%

With policies unchanged and assuming that the measures taken to combat the pandemic will have only a temporary effect in 2020, an economic recovery is expected in 2021.

As uncertainty dissipates, investment should recover.

As a small open economy with strong commercial and financial links to international markets, Luxembourg is highly exposed to external risks. The uncertainty related to the end of the COVID-19 crisis, and any financial turmoil that may ensue, could prove less benign for its economy.

Mexico-Luxembourg Bilateral Trade

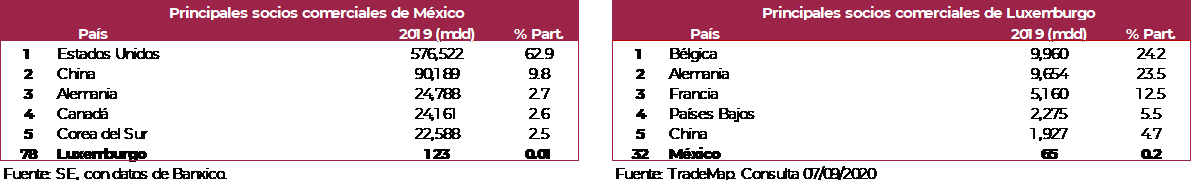

According to data from the Ministry of the Economy (SE), in 2019 Luxembourg was Mexico's 78th trading partner worldwide and 22nd among the countries of the European Union (EU)

Bilateral trade in 2019:

$ 123.1 million dollars in 2019, 34.7% less than in 2018 ($ 188.4 million dollars).

Mexican exports: $ 32.7 million dollars, 44.5% higher than in 2019 ($ 22.6 million dollars).

Imports of Luxembourgish products: $ 90.4 million dollars, 45.5% less than in 2018 ($ 165.8 million dollars).

Mexico's trade deficit of $ 57.8 million, lower than the deficit of $ 143.2 million registered in 2018.

Free Trade Agreement (FTA) period 2000-2019:

With the Mexico-EU Trade Agreement, trade between our country and Luxembourg grew 675%, from $ 15.9 million in 1999 to $ 123.1 million in 2019.

Trade between Mexico and Luxembourg increased at an Annual Average Growth Rate (AAGR) of 10.8% in the reference period. Mexican exports grew 8.9% AAGR, going from $ 5.9 million dollars in 1999 to $ 32.7 million dollars in 2019, and imports increased 11.6% AAGR, going from $ 10 million dollars in 1999 to $ 90.4 million dollars in 2019.

Evolution of bilateral trade:

In 2019, there was a decrease in bilateral trade for the second consecutive year:

Imports contracted sharply due to lower purchases of medical, surgical, dental or veterinary instruments and devices; pharmaceutical preparations and articles, electric machines and apparatus with their own function, centrifuges and styrene polymers.

Mexican exports increased significantly, thanks to the rise in flat alloy steel products; machines for mounting electric or electronic lamps, tubes or valves; knitting fabric and ethylene polymers in primary forms.

In the last 5 years (2015-2019), bilateral trade registered a negative Average Annual Growth Rate (AAGR) of 13.5%, going from $ 254.8 million dollars in 2014 to $ 123.1 million dollars in 2019.

In this same period, Mexican exports decreased by 25.1% AAGR, from $ 138.4 million dollars to $ 32.7 million dollars.

While imports of products from Luxembourg decreased 4.9% AAGR, going from $ 116.4 million dollars in 2014 to $ 90.4 million dollars in 2019.

Main export products: iron or non-alloy steel; alloy steel flat products; machines for assembling electric or electronic lamps, tubes or valves; ethylene polymers, in primary forms and synthetic filament yarns.

Main import products: dates, figs, pineapples, avocados, guavas, and mangoes; automatic instruments and apparatus for regulation or control; strawberries, raspberries, blackberries, currants and other edible fresh fruits; media prepared for recording sound or recordings; machines and electrical appliances.

Business opportunities

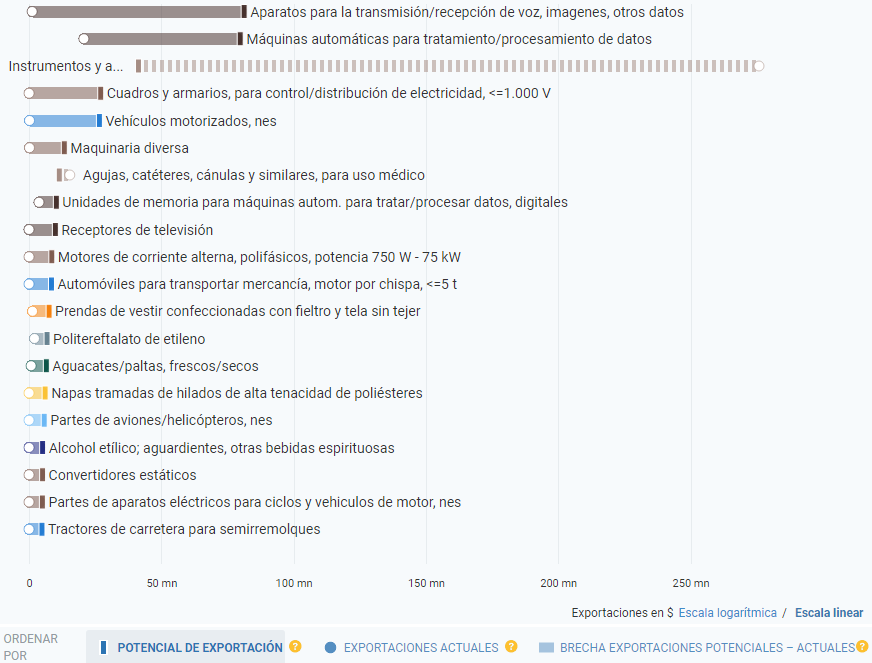

According to data from the International Trade Center (ITC), the products with the greatest export potential from Mexico to Luxembourg are electronic equipment (devices for the transmission / reception of voice, images, other data; automatic machines for data treatment / processing; memory units for automatic machines for processing digital data; televisions); medical devices (surgical / veterinary instruments; needles, catheters, cannulas and the like; machinery (panels and cabinets for the control / distribution of electricity; various machinery; alternating current motors; static converters; parts of electrical apparatus for cycles and motor vehicles); vehicles and their parts (motorized vehicles; automobiles for transporting goods; road tractors for semi-trailers); clothing and accessories (clothing made from felt and nonwovens); chemical inputs (polyethylene terephthalate); food and beverages (avocado; spirits); and synthetic fabrics (woven webs of high tenacity polyester yarns).

The best diversification options for Mexico in the Luxembourg market are fresh / dried pistachios; aircraft, and high tenacity viscose rayon yarn.

Mexico has certain advantages for selling alcoholic beverages.

The aircraft industry may have greater demand potential in Luxembourg.

Investment between Luxembourg and Mexico

Luxembourg in Mexico

According to information from the Ministry of the Economy, Luxembourg is the 33rd investor in Mexico worldwide and the 13th within the European Union. The accumulated FDI of Luxembourg in Mexico between 1999 and June 2020 is $ 340.3 million dollars.

In Mexico there are 98 companies with capital from Luxembourg.

In the five-year period 2015-2019 FDI flows totaled 97 million dollars. This figure represents an important recovery when compared to the divestment of -9 million dollars in the previous five-year period 2010-2014. Divestments were reported in the Professional, Scientific and Technical Services, Business Support Services, and Waste Management and Remediation Services.

Sectors

FDI reported as non-confidential and amounts to $ 95.6 billion is mainly in Real estate services and rental of movable and intangible assets; Trade and Information in mass media and manufacturing industries.

Investments by State (region)

Luxembourg's FDI in Mexico was mainly distributed in Mexico City (around 76%), Querétaro, the State of Mexico and Chihuahua.

Mexico in Luxembourg

According to information from the IMF, the 2018 stock of Mexico's investment in Luxembourg is reported as confidential.

Economic Relations with the European Union

Bilateral trade

The EU is Mexico's 3rd trading partner, after the United States ($ 576 billion) and China ($ 90.1 billion), and represents 8.2% of the country's total trade. In turn, Mexico is the 11th trading partner of the EU.

Since the entry into force of the Global Agreement, trade in goods between both Parties has grown more than 300%, going from USD 18.7 billion in 1999, the last year before the entry into force of the current Agreement, to 75.4 billion in 2019. In that year, exports reached 24.2 billion and imports reached 51.2 billion. Bilateral trade between Mexico and the EU increased at an Annual Average Growth Rate (AAGR) of 7.3% in the referred period.

Among the main export products from Mexico to the EU are machinery and household appliances (6.7 billion USD); transportation vehicles, mainly automobiles (6.5 billion); mineral products (4.1 billion); and optical and photographic instruments (3.5 billion). 71.2% of Mexican exports to the EU are manufactures.

With regards to agricultural products, the main export products to the EU (2018) are avocados ($ 131 million), coffee ($ 111 million), fruit juices ($ 105 million), lemons ($ 43 million), berries ($ 31 million) and canned fruits ($ 31 million). Also, beer exports were worth $203 million.

In turn, the main products that Mexico imports from the EU are machinery and electrical appliances, transport equipment, chemicals, metals and plastics.

1Source: http://ec.europa.eu/trade/policy/countries-and-regions/countries/mexico

Investment

According to data from the Ministry of Economy of Mexico, the members of the European Union represent 31.1% of the investments in Mexico in the years 1999-2020 , with USD 186.3 billion, which positions the EU as the 2nd most important investor in the country. The United States is first with 268 billion, Canada is third with 40.5 billion, and Japan is fourth with 25 billion.

The main European investors are: Spain ($ 69.1 billion), Germany ($ 24.8 billion), The Netherlands ($ 20.8 billion), Belgium ($ 20 billion), and the United Kingdom ($ 17 billion). European investment is concentrated in the following sectors: automotive, aerospace, beverages and pharmaceuticals.

EU investment in Mexico was concentrated mainly in the manufacturing industry (45.7% of the total); financial services (20.4%); generation, transmission and distribution of electrical energy, supply of water and gas through pipelines to the final consumer (7.9%); information in mass media (7.8%), and construction (5.4%).

In Mexico, there are 19 080 companies with capital from the European Union distributed mainly in Mexico City (23.6%), Estado de México (10.8%), Nuevo León (8.6%), Puebla (5.6%) and Jalisco (5.4%).

1Statistical information on FDI, with data for the second quarter of 2020, available here: https://datos.gob.mx/busca/dataset/informacion-estadistica-de-la-inversion-extranjera-directa

Protection of Tequila

On March 20, 2019, the European Union granted the registration of "Tequila" as a Geographical Indication to the government of Mexico, the highest recognition within the EU to protect this spirit drink against counterfeiting and unfair competition.

Tequila is the first Mexican Appellation of Origin protected by the EU as a geographical indication under Regulation 110/2008.

Although Tequila was protected in the EU through a specific agreement on the mutual recognition and protection of designations for spirit drinks, this new recognition means additional protections for Mexican producers in the agro-industrial chain of this drink with respect to imitations or uses of the Appellation of Origin Tequila in EU countries, which contributes to diversifying and increasing Mexican exports to this part of the world. It also brings advantages to the consumer in terms of ensuring the characteristics and quality of the sealed product.

The Appellation of Origin Tequila is a mechanism for the protection of industrial property that allows promoting the economic development of communities through investments and direct jobs, as well as through services such as tourism.

The registration is available in the following link: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32019R0335

The European Commission hands over the certificate of registration for Tequila